In a surprising twist amid volatile market conditions, Ola Electric Mobility Ltd. surged nearly 14% in intraday trading this week, driven by an unexpected upgrade in operating margin forecasts. The move sent ripples across the EV sector, signaling renewed investor confidence in the homegrown electric two-wheeler giant.

Margin Boost Sparks Momentum

The rally followed reports that Ola Electric had improved its EBITDA margins, moving closer to profitability far earlier than anticipated. The company’s internal estimates, now corroborated by select brokerage models, reflect a streamlined cost structure, operational efficiency, and improved economies of scale.

A spokesperson from Ola Electric confirmed that “We’ve seen significant improvement in unit economics driven by manufacturing scale, supply chain stabilization, and localization of components.”

These efficiencies, combined with higher average selling prices (ASPs) due to premium scooter models like S1 Pro Gen 2, helped narrow losses and improve gross margins across product lines.

Street Reacts with Optimism

As the news broke, trading volumes soared past 18 million shares, well above the daily average. The NSE saw a surge in retail and institutional buying, with key market analysts viewing this as a “corrective re-rating” after a months-long underperformance since its listing.

Notably, HSBC revised its price target for Ola Electric from ₹42 to ₹49, citing operational improvements and robust EV demand. However, it maintained a “Hold” rating, flagging concerns about policy dependency and heightened competition from Bajaj, Ather, and TVS.

“Ola Electric’s fundamentals are finally aligning with its ambitions. The cost discipline, paired with steady volume growth, gives it breathing room in a tight market,” said Raghav Arora, EV sector analyst at CapitalAxis Research.

EV Industry Tailwinds and Policy Support

The company’s positive momentum also reflects broader tailwinds in India’s electric mobility landscape. Recent government incentives through FAME-II subsidies, and newer state-level policies, continue to promote EV adoption. Ola Electric’s recent introduction of lower-cost variants has expanded its customer base beyond Tier-1 cities, boosting market penetration.

Moreover, the company is pushing forward with its gigafactory project in Tamil Nadu, which aims to localize battery cell manufacturing and reduce dependence on imports — a strategic move that could dramatically reduce costs by 2026.

Turnaround After a Bumpy Start

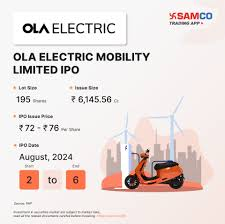

The rally comes as a relief for investors who endured a rocky start after Ola Electric’s public debut in May 2025, which saw shares slide over 30% from the IPO issue price amid concerns over losses and delivery delays.

However, with this recent upswing, Ola Electric is closing the valuation gap with peers like Ather Energy and Bajaj Auto, signaling that the company may finally be stabilizing both its business model and investor sentiment.

What’s Next?

Industry watchers are eyeing the upcoming Q2 FY2026 earnings report, which could validate whether Ola Electric’s margin momentum is sustainable or a temporary blip. The firm’s ability to execute battery manufacturing at scale and maintain delivery consistency will be key determinants of long-term investor confidence.

Until then, Ola Electric’s 14% leap marks a strong statement in a sector still maturing — one that hints at the possibility of the EV unicorn turning into a profitability powerhouse.

ALSO READ :Comet Launch: Perplexity’s AI Browser Sparks Browser Wars

Last Updated on: Thursday, July 17, 2025 11:00 pm by Muthangi Anil Kumar | Published by: Muthangi Anil Kumar on Thursday, July 17, 2025 11:00 pm | News Categories: Business