As startups move beyond early experimentation into scale, one challenge begins to dominate boardroom discussions: retaining high-performing talent. Competitive salaries alone are no longer enough in an ecosystem where skilled professionals have global opportunities. For growth-stage startup founders, Employee Stock Ownership Plans, or ESOPs, have emerged as a critical tool to retain teams, align incentives, and build long-term commitment. However, many ESOP programs fail to deliver their intended value due to poor design, weak communication, or unrealistic expectations.

Making ESOPs truly valuable requires more than allocating a pool of shares. It demands a thoughtful strategy that connects equity with career growth, financial clarity, and the company’s long-term vision.

The Changing Role of ESOPs in Growth-Stage Startups

In the early days of a startup, equity is often positioned as a leap of faith, compensating for lower cash salaries and higher risk. As companies mature, this equation changes. Growth-stage startups typically have stronger revenues, repeat customers, and institutional investors. Employees joining at this stage expect not just ownership, but a credible path to value creation.

At the same time, repeated funding rounds and expanding ESOP pools raise concerns around dilution for founders and early investors. This makes it essential for ESOPs to be deployed with precision. When structured well, ESOPs can reinforce loyalty and motivation. When handled poorly, they become a source of confusion and disengagement.

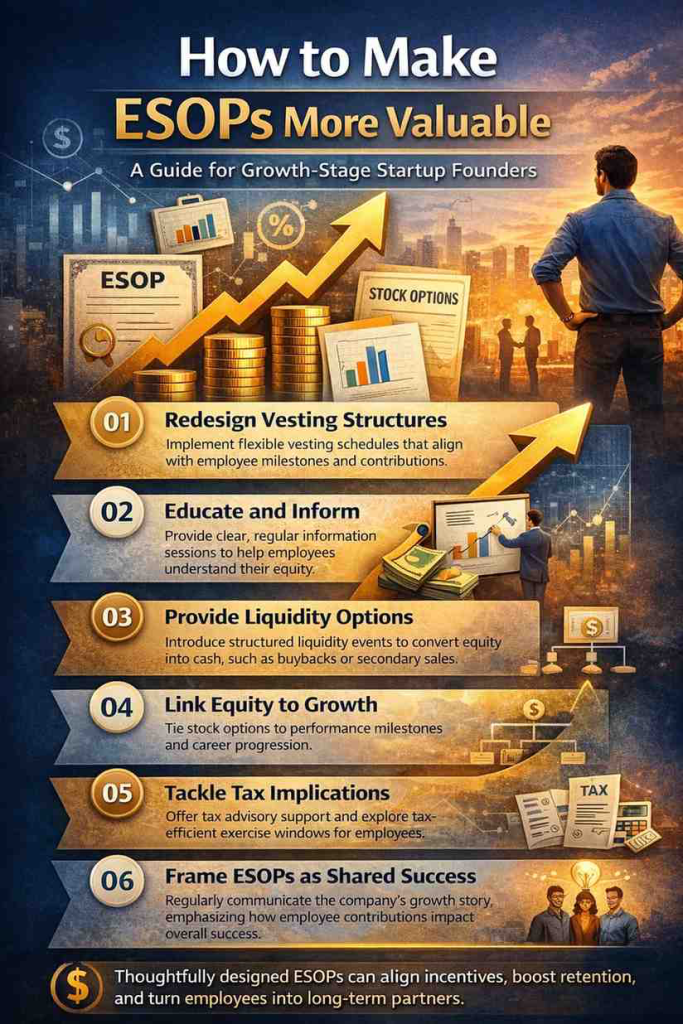

Designing Vesting Structures That Reflect Real Careers

The traditional four-year vesting schedule with a one-year cliff has long been the industry standard. Yet, for many growth-stage employees, this structure feels disconnected from their professional timelines. Senior hires and lateral entrants often contribute significant value early on and expect recognition sooner.

Progressive startups are responding by redesigning vesting schedules to better reflect contribution and tenure. Shorter cliffs, milestone-linked vesting, and periodic equity refreshes are becoming more common. These changes reinforce the idea that equity is not a one-time promise but an evolving reward tied to sustained impact.

Why Equity Education Determines Perceived Value

One of the most common reasons ESOPs lose their motivational power is lack of understanding. Employees may know how much they earn in salary, but struggle to explain what their stock options are worth or when they can realistically benefit from them.

Growth-stage founders who invest in equity education see significantly better outcomes. When employees understand concepts such as valuation, dilution, exercise price, and exit scenarios, ESOPs shift from abstract benefits to tangible assets. Regular communication sessions, simple financial explanations, and real-world scenarios help demystify equity and build trust.

Liquidity: Turning Paper Wealth into Real Value

For employees, the biggest uncertainty around ESOPs is liquidity. Holding shares in a private company can feel meaningless without clarity on when and how those shares can be converted into money. This uncertainty often leads employees to discount the value of their equity entirely.

Founders can address this challenge by clearly outlining potential liquidity pathways. Secondary share sales during funding rounds, structured buyback programs, or partnerships with regulated liquidity platforms provide reassurance. Even limited liquidity opportunities significantly improve how employees perceive the worth of their equity.

Integrating ESOPs with Performance and Growth

Equity becomes far more powerful when it is woven into the broader performance and career framework. Employees are more likely to stay when they see a direct connection between their work, their growth within the company, and the value of their equity.

In growth-stage startups, promotions, leadership roles, and long-term impact should naturally trigger conversations about equity. When ESOPs are treated as a living component of compensation rather than a static grant, they reinforce a sense of ownership and accountability across teams.

Managing Tax Expectations and Financial Stress

Taxation remains one of the most underestimated aspects of ESOP planning. In many jurisdictions, employees face tax liabilities at the time of exercising options, even if no liquidity event has occurred. Without adequate guidance, this can create financial stress and discourage employees from exercising their options altogether.

Startups that proactively address tax implications through education sessions, advisory support, and flexible exercise windows remove a major psychological barrier. When employees feel supported through the financial complexity of equity ownership, trust in the ESOP program increases significantly.

Communicating ESOPs as a Shared Growth Story

Beyond mechanics and numbers, ESOPs work best when they are framed as part of a shared journey. Employees are more engaged when they understand how their individual contributions influence company milestones and, in turn, equity value.

Consistent updates on business performance, funding developments, and long-term strategy help reinforce this narrative. Transparency builds credibility, while realistic messaging ensures expectations remain grounded. Over time, ESOPs become a symbol of partnership rather than a speculative reward.

Founder Perspectives from the Startup Ecosystem

Many founders admit that ESOP strategies evolve through trial and error. Initial plans designed for early-stage survival often fail to scale with the organization. Those who revisit and refine their ESOP frameworks during growth phases report lower attrition and stronger leadership pipelines.

Founders increasingly recognize that equity is not just a compensation tool, but a cultural signal. A well-managed ESOP program communicates fairness, ambition, and long-term thinking—qualities that attract and retain high-caliber talent.

The Road Ahead for Startup Equity

As startup ecosystems mature, ESOPs are expected to become more sophisticated and standardized. Hybrid equity models, flexible vesting mechanisms, and clearer regulatory frameworks are likely to define the next phase. For growth-stage startups, this evolution presents an opportunity to build equity programs that are both competitive and sustainable.

Ultimately, ESOPs deliver the greatest value when they balance aspiration with clarity. They must inspire employees while remaining realistic about timelines and outcomes.

Conclusion: Making ESOPs a Strategic Advantage

For growth-stage startup founders, ESOPs are no longer optional perks—they are strategic necessities. When thoughtfully structured, clearly communicated, and aligned with company growth, ESOPs can transform employees into long-term partners.

In an era where talent retention can determine a startup’s success or failure, making ESOPs more valuable is not just good governance. It is a decisive investment in the company’s future.

Add indianewsbulletin.in as a preferred source on google – click here

Last Updated on: Tuesday, January 27, 2026 10:34 am by Indian News Bulletin Team | Published by: Indian News Bulletin Team on Tuesday, January 27, 2026 10:34 am | News Categories: News