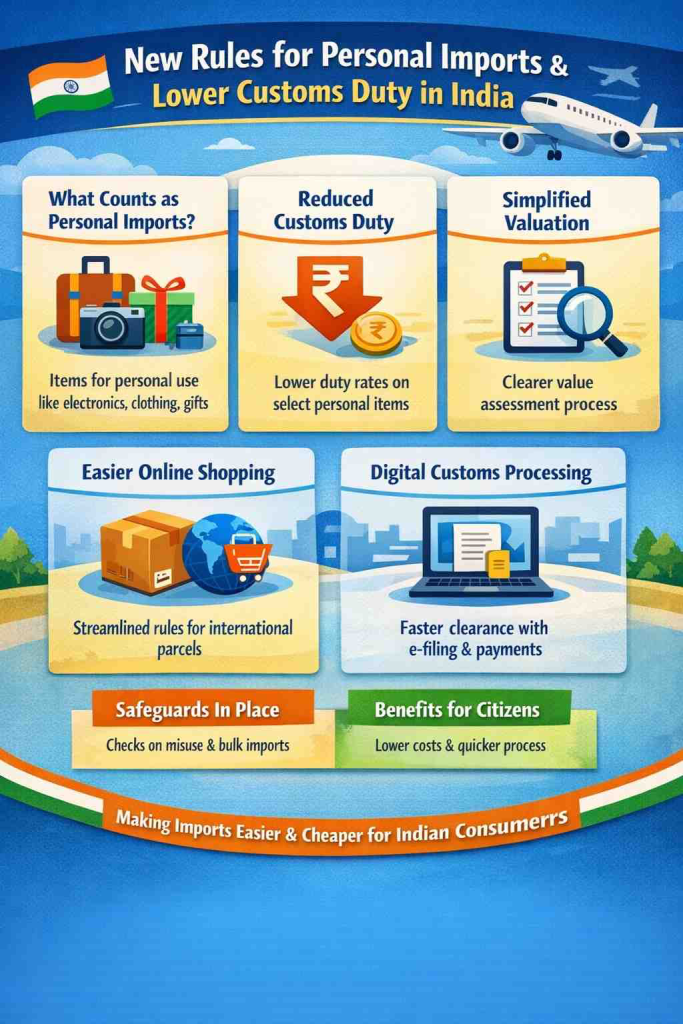

In a move that directly affects millions of Indian citizens, the government has introduced updated rules governing personal imports along with revisions in customs duty structures. These changes are designed to simplify procedures, reduce unnecessary costs, and bring greater transparency to how goods brought from abroad for personal use are assessed and cleared at Indian ports and airports. For frequent international travellers, online shoppers using global platforms, and families receiving items from overseas relatives, the update marks a significant change in day-to-day import experiences.

The revised framework reflects the government’s broader objective of aligning customs regulations with evolving consumer habits, particularly the rise in cross-border e-commerce and the growing movement of Indians for work, education, and tourism.

What Qualifies as Personal Import Under the Updated Rules

Personal imports are goods brought into India for individual use and not intended for resale or commercial distribution. The updated rules clarify this definition more precisely to reduce confusion at customs checkpoints. Items such as clothing, personal electronics, household goods, books, gifts, and small appliances are covered, provided they fall within prescribed value limits and quantity norms.

By clearly distinguishing personal imports from commercial consignments, authorities aim to reduce disputes between passengers and customs officials while ensuring that genuine personal-use goods are not subjected to higher duties meant for traders.

Lower Customs Duty Brings Relief to Travellers and Families

One of the most welcomed aspects of the update is the rationalisation of customs duty on certain categories of personal imports. The government has lowered duty rates on select commonly used items to reflect current market realities and inflationary pressures. This change is particularly beneficial for Indian citizens returning from abroad with personal belongings or essential electronics, as well as families importing gifts for festivals, weddings, or personal milestones.

The reduction in duty is also expected to discourage informal channels and under-declaration, encouraging citizens to comply with legal import procedures without fear of excessive taxation.

Clearer Value Assessment to Reduce Disputes

Customs valuation has long been a point of friction for travellers, often due to inconsistent assessment methods. Under the new rules, valuation guidelines have been streamlined to ensure uniformity across airports, seaports, and courier clearance centres. Declared invoice values, where available, are given greater weight, while standard reference prices are applied more consistently when documentation is missing.

This shift is expected to reduce arbitrary assessments, shorten clearance times, and provide citizens with a clearer understanding of how duty is calculated on their personal imports.

Impact on Online Shopping from International Platforms

With Indian consumers increasingly ordering products from overseas websites, the updated customs rules also address courier and postal imports. Personal parcels sent through international e-commerce platforms are now covered under clearer duty thresholds and simplified documentation requirements. This move aims to balance consumer convenience with revenue protection, ensuring that small-value personal shipments are processed smoothly without unnecessary delays.

For consumers, this translates into fewer unexpected charges, faster delivery timelines, and greater predictability in final costs.

Simplified Compliance and Digital Processing

Another key feature of the update is the push towards digital customs processing. Online declaration systems, electronic payment of duty, and automated risk assessment tools are being expanded to cover personal imports more comprehensively. This reduces paperwork, limits physical interactions, and enhances transparency in decision-making.

The government believes that digitalisation will not only improve the passenger experience but also help customs authorities focus their resources on high-risk consignments rather than routine personal imports.

Safeguards Against Misuse Remain in Place

While the rules are more citizen-friendly, safeguards against misuse have not been diluted. Goods imported in bulk quantities, repeated high-value imports under personal categories, or items restricted under Indian law will continue to attract scrutiny. Customs officials retain the authority to reclassify consignments if evidence suggests commercial intent or misdeclaration.

This balanced approach ensures that genuine users benefit from relaxed norms while preventing revenue leakage and unfair trade practices.

What Citizens Should Keep in Mind Going Forward

Travellers and importers are advised to retain purchase invoices, understand duty-free limits, and make accurate declarations to avoid penalties. Awareness of the revised rules can significantly reduce inconvenience during customs clearance and help citizens plan their purchases more efficiently.

The government has indicated that these reforms are part of an ongoing review process, suggesting further refinements may follow as consumer behaviour and global trade patterns continue to evolve.

A Step Towards a More Consumer-Centric Customs System

Overall, the new rules for personal imports and lower customs duty represent a clear shift towards a more transparent, predictable, and citizen-focused customs regime. By easing the financial and procedural burden on individuals while maintaining regulatory oversight, the update strengthens trust between citizens and authorities.

As India becomes increasingly connected to the global marketplace, such reforms play a crucial role in ensuring that international mobility and cross-border shopping remain accessible, lawful, and hassle-free for ordinary citizens.

Add indianewsbulletin.in as a preferred source on google – click here

Last Updated on: Wednesday, February 4, 2026 6:18 pm by Indian News Bulletin Team | Published by: Indian News Bulletin Team on Wednesday, February 4, 2026 11:48 am | News Categories: News