India’s Union Budget 2026–27 has ushered in one of the most significant overhauls to the country’s direct tax framework in decades. Two pillars of this transformation—reforms to the Minimum Alternate Tax (MAT) and the shift in taxation of share buyback proceeds to capital gains—are set to come into effect from April 1, 2026 under the new Income-tax Act, 2025. These changes, aimed at simplifying tax structures and enhancing fairness, will have wide-ranging implications for corporations, investors and individual taxpayers alike.

A Recalibrated MAT: Final Tax and Simplified Compliance

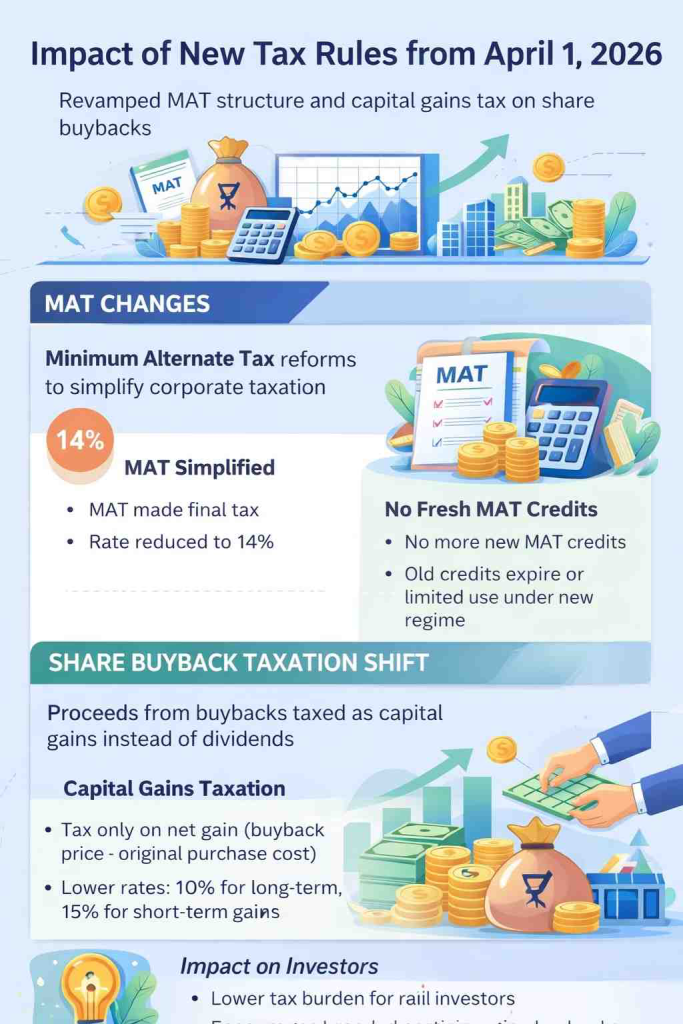

The overhaul of MAT represents a major shift in corporate tax architecture. Historically, MAT ensured that companies paid a minimum level of tax by calculating tax on “book profits” when normal taxable income was reduced through exemptions and deductions. With the new reforms, MAT is being made a final tax, with its rate reduced from 15 per cent to 14 per cent. This step aims to simplify compliance for firms in the old regime and to encourage adoption of the new concessional corporate tax regime with lower rates and fewer complexities.

Under the revised framework, companies that pay MAT will no longer accrue fresh MAT credits for future years. Previously, when a company paid MAT because its normal tax liability was low, the excess MAT paid could be carried forward and set off against future regular tax liabilities—a feature that served as a tax planning tool. Now, such credits will either expire or be partly used up to a limited extent (25 per cent of new regime tax liability) if the company opts into the new corporate regime.

For many Indian firms, this simplifies planning but also demands strategic decisions about which tax regime to choose for the long term. Corporations with accumulated MAT credits, particularly from previous years, may face challenges in fully utilising them unless they transition to the concessional regime.

Why This Matters to You

For corporate leaders and investors, the MAT reforms reduce tax complexity while nudging businesses toward a single, transparent corporate tax regime. However, companies must now carefully evaluate the trade-off between losing the flexibility afforded by MAT credits and moving to a regime with more predictable tax outcomes. For businesses with fluctuating profits and heavy depreciation cycles, the timing and choice of tax regime could influence investment decisions, dividend policies and long-term financial planning.

Share Buybacks: From Dividend to Capital Gains Taxation

Parallel to the MAT changes, the Budget has radically restructured how proceeds from share buybacks are taxed. Previously, when a company repurchased its own shares, the amount received by investors was treated as dividend income, taxed according to their income tax slab rate. This meant that shareholders could effectively pay tax on their entire payout—even the portion that merely returned their own investment—often at rates up to 30 per cent plus surcharge and cess.

From April 1, 2026, this treatment will be replaced with a capital gains framework. Under the new rules, tax will be levied only on the net gain—that is, the buyback price minus the cost at which the investor originally acquired the shares. This mirrors the taxation applicable when shares are sold in the market rather than being bought back by the company.

How Capital Gains Taxation Works in Practice

The capital gains regime distinguishes between long-term and short-term gains, with different rates based on how long the shares were held before the buyback. Long-term gains typically attract a 12.5 per cent tax rate, while short-term gains are taxed at 20 per cent on listed shares (and higher slab rates may apply to certain unlisted holdings). Importantly, under this new structure the cost of acquisition is fully deductible before computing taxable gains, a feature absent under the old dividend approach.

Differential Treatment for Promoters

To prevent potential misuse of the buyback route as a tax arbitrage tool, the Finance Bill also introduces an additional levy on promoters. Promoter shareholders—individuals or entities with controlling stakes—will face an effective tax rate that is significantly higher than for ordinary investors: approximately 22 per cent for corporate promoters and 30 per cent for non-corporate promoters. The intent is to maintain comparable tax outcomes for promoters that would have applied under the dividend regime, while still simplifying overall tax administration.

Impact on Small Investors and Markets

For minority and retail investors, this realignment is generally favourable. The shift to capital gains ensures that tax is charged only on genuine profits, not on the entire buyback consideration. In many scenarios, this can substantially reduce the tax burden, making share buybacks a more attractive option for realising investment gains. Financial advisors point out that this clarity may encourage broader participation in buybacks, particularly among long-term market participants who stand to benefit from lower effective tax rates on gains rather than high slab rate taxation on entire payouts.

However, the impact on market behaviour is complex. Equity markets may see adjustments as companies rethink the attractiveness of buybacks versus dividends or reinvestment strategies. Promoters, facing higher effective rates, may be dissuaded from aggressive buyback programmes purely for tax-saving purposes.

What You Should Do Next

From an individual investor’s perspective, understanding these revisions is crucial ahead of the new tax year starting April 1. Investors should review their portfolios with an eye toward the holding periods of shares, as long-term positions may now benefit from significantly lower capital gains taxation on buyback proceeds. For companies and promoters, proactive tax planning that considers the choice of tax regime (old vs. new), utilisation of MAT credits, and long-term shareholder return strategies will be key to optimising tax outcomes under the revamped system.

In essence, India’s tax architecture is moving toward greater transparency and fairness, balancing revenue mobilisation with investor protection and corporate competitiveness. The new MAT configuration and capital gains focus for buybacks mark a pivotal shift in how investors and corporations alike engage with the tax system.

Also read :Important Update for Citizens: New Rules for Personal Imports and Lower Customs Duty Explained

Add indianewsbulletin.in as a preferred source on google – click here

Last Updated on: Thursday, February 5, 2026 10:55 am by Indian News Bulletin Team | Published by: Indian News Bulletin Team on Thursday, February 5, 2026 10:55 am | News Categories: News